-

Personal Loans

- Business Loan

- Gold Loan

-

Credit Cards

- Credit Report

- Login

Products

Personal Loans Business Loan Gold Loan Credit CardsResources

EMI Calculator IFSC Code Blogs FAQs

Products

Personal Loans Business Loan Gold Loan Credit CardsResources

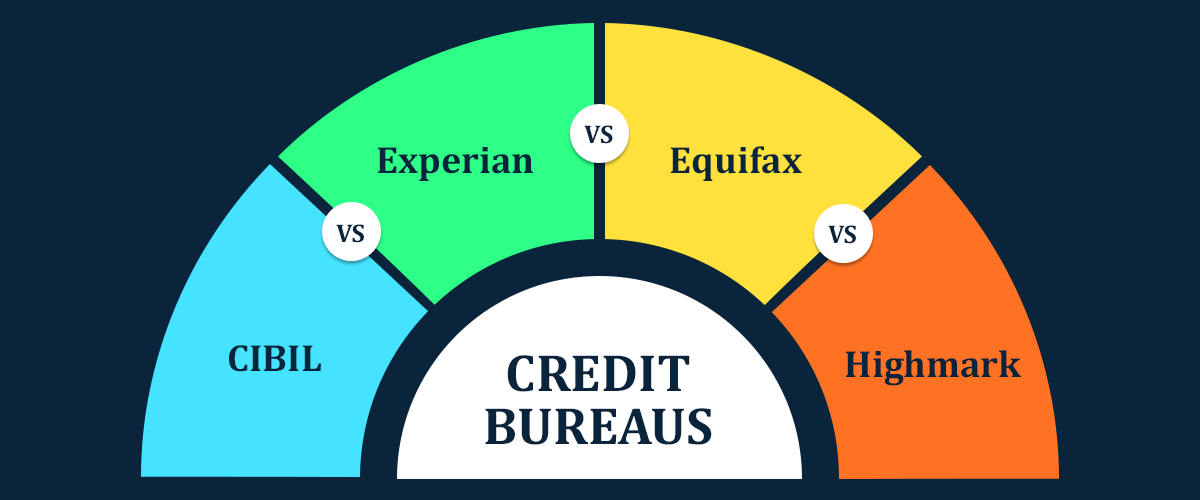

EMI Calculator IFSC Code Blogs FAQsBlogs > Credit Bureaus in India | CIBIL vs Experian vs Equifax vs Highmark

When it comes to lending, banks/NBFCs need to be assured about the person to whom they are providing a loan. This is where the role of Credit Information Company (CIC) or credit bureau play importance. In fact, the process of checking customer background verification has now become easier.

A credit bureau or credit information company is a financial institution that determines the creditworthiness of a debtor. These companies maintain a record of the financial activities conducted by the customer and provide scores. Moreover, the scores, also known as credit scores help in deciding the financial standing of the customer. This also helps in approving/rejecting a loan application.

There are four credit bureaus in India, namely

As per the RBI guidelines, every bank/NBFC must be a member of at least one of the credit bureaus in India. In fact, the CICs collect and maintain loan-related information of individuals owning a PAN card from the member credit institutions. On the basis of this, you get an updated report on a monthly basis or at short intervals.

Credit bureaus in India collect, maintain, and provide credit information from its member institution (banks/NBFCs). The information would include detailed repayment history (including missed or late payments), loan and credit card applications and corresponding approvals and rejections. It also includes total credit limit, defaults, the age of accounts, the status of credit accounts( whether Written Off, Closed, Settled or Current) among other information.

Based on this data, the CICs generate a credit score and a credit report that is beneficial for both, the lenders and borrowers. In fact, the credit score gives a clear idea of how responsible the borrower is. In fact, the borrower too gets the benefit as they become aware of their credit situation. And what they need to do to become loan-worthy.

Here is a brief summary of all the credit bureaus of India.

TransUnion CIBIL is the oldest credit bureau in India. It helps financial institutions like banks, and others to manage their business. Moreover, there are three divisions, commercial bureau, consumer bureau and MFI bureau.

| Parameter | CIBIL |

|---|---|

| Year of establishment | 2000 |

| Cost of credit report and credit score | ₹550/- |

| Scoring system | 300-900 where 900 is the perfect credit score |

| Time taken to generate the report | 7 days |

Experian Credit Information Company or Experian is a joint venture of GUS Holdings, Axis Bank, Indian Bank, Union Bank of India,, Punjab National Bank, Magna Fincorp Ltd, Sundaram Finance Ltd, and VIC Enterprises Private Ltd. It aims to provide credit information services to banks and NBFCs.

| Parameter | Experian |

|---|---|

| Year of establishment | 2006, the license granted in 2010 |

| Cost of credit report and credit score | ₹399 including taxes(Credit report + Credit score) |

| Scoring system | 300-900 where 900 is the perfect credit score |

| Time taken to generate the report | 20 days |

Equifax India is a joint venture between Equifax USA, State Bank of India, Religare Finvest Ltd., Bank of Baroda, Kotak Mahindra Bank, Sundaram Financial Services and Union Bank of India. It caters to a wide range of credit services including business analysis and risk management.

| Parameter | Equifax |

|---|---|

| Year of establishment | 2010 |

| Cost of credit report and credit score | ₹400 plus (Credit report + Credit score) |

| Scoring system | 1-999 where 1 is the lowest and 999 being the highest |

| Time taken to generate the report | 10 days |

CRIF Highmark is the only credit bureau in India that caters the need of segments like commercial borrowers, retailer, MSME, microfinance borrowers. It provides analytics and related credit services.

| Parameter | Highmark |

|---|---|

| Year of establishment | 2007, the license granted in 2010 |

| Cost of credit report and credit score | N/A |

| Scoring system | 300-900 where any score above 720 is excellent and score below before 640 is poor. |

| Time taken to generate the report | N/A |

Please note that every credit bureau provides a free credit report once a year. Moreover, the credit scores of all the credit bureaus would differ as each bureau has its own credit models. Even the lenders are aware of this difference, and take the decision keeping in mind of this difference.