-

Personal Loans

- Business Loan

- Gold Loan

-

Credit Cards

- Credit Report

- Login

Products

Personal Loans Business Loan Gold Loan Credit CardsResources

EMI Calculator IFSC Code Blogs FAQs

Products

Personal Loans Business Loan Gold Loan Credit CardsResources

EMI Calculator IFSC Code Blogs FAQsBlogs > Factors That Decide Your Credit Score Explained

A credit report shows the score based on your credit activities. However, there are different factors that decide your credit score. A credit score is one of the important factors that affect the decision-making of any lender. In fact, it is the numeric expression that helps to assess the financial standing of the customer.

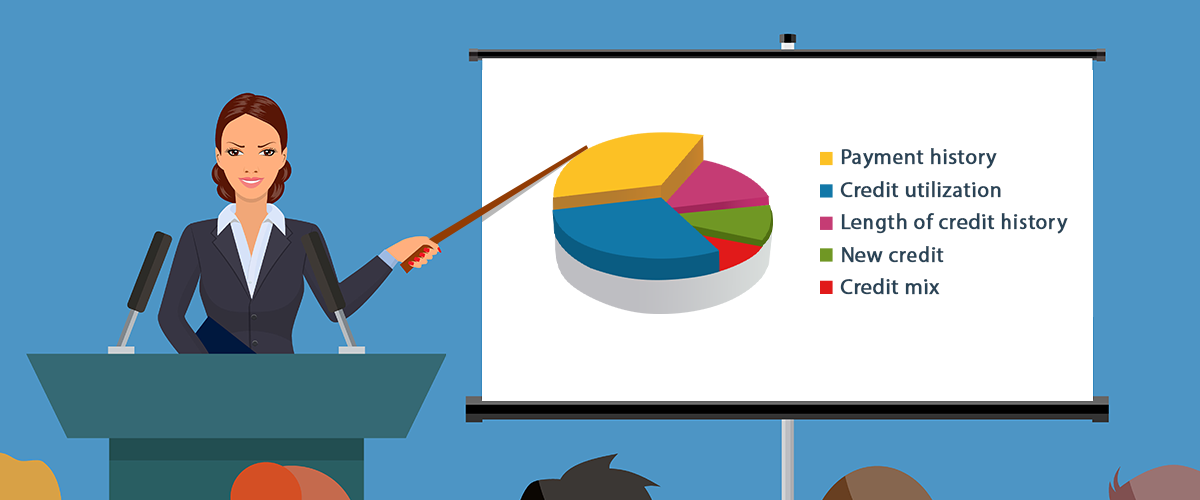

There are majorly five factors that decide your score. The components that help in calculating your score are explained below:

Your payment history plays the most important role in the calculation of your credit score. It comprises of 35% of the total score. This factor majorly comprises of your past long-term behavior.

In fact, all credit bureaus keep an eye on revolving loans – such as credit cards and installment loans such as mortgages, or any other form of a loan.

The subdivisions of payment history with a score are:

This is why a borrower must make consistent and timely payments to improve his/her credit score.

Credit utilization is the percentage of available credit you have borrowed. It comprises of 30% of your total score. All potential lenders keep a track of customers if they habitually max out their credit card limit. They also check if the customer is very close to the available credit limit.

This helps the lenders assess the creditworthiness of the customer. It is considered that a person who handles credit responsibly will maintain low credit balances. Credit utilization is maintained individually by card and across all credit cards.

The above two factors affect the calculation of a score the most. They cover two-thirds of a credit score. So, if you pay the bills on-time and maintain low credit utilization ratio, you are halfway across a good score.

The length of your credit accounts also decides your credit score. In fact, it comprises 15% of your total score. In fact, a long-term credit history offers a better picture of the financial behavior of a customer. It provides better information about the customer as to how the customer has been performing financially. Therefore, it is an important factor in deciding your credit score.

So, a person who is new-to-credit must begin using a credit card; and an existing customer must maintain long-standing accounts to improve your score.

New credit comprises 10% of the total credit score. It is always advisable to avoid opening too many credit accounts. Which is why it is recommended to avoid applying for too many applications at the same time. New accounts lower the average credit age of an account resulting in a lower score.

The term credit mix is a very unpopular concept constituting 10% of the total credit score. Repaying a variety of debt can give the lenders an impression that the customer is able to handle all sorts of credit. Borrowers with a good credit mix of both, revolving credit and installment loan represent less risk for lenders.

Knowing the various factors that decide your score can give a customer a better idea of where to focus his/her attention.

#ProTip: Check your free credit report online to see which factor you should focus more to improve your score.