-

Personal Loans

- Business Loan

- Gold Loan

-

Credit Cards

- Credit Report

- Login

Products

Personal Loans Business Loan Gold Loan Credit CardsResources

EMI Calculator IFSC Code Blogs FAQs

Products

Personal Loans Business Loan Gold Loan Credit CardsResources

EMI Calculator IFSC Code Blogs FAQsBlogs > What Are The Different Income Tax Forms?

The first step to seeking your Income Tax Refunds from the Government is identifying which Income Tax Return form to fill. To start with, this can be a bit tricky.

Some major changes have been implemented in the ITR forms for Financial Year (FY) 2017-18. There are currently 7 ITR forms which you can fill up, depending on your income tax slabs and type of income.

Let’s take a look at all of them to help you gain a better understanding of each.

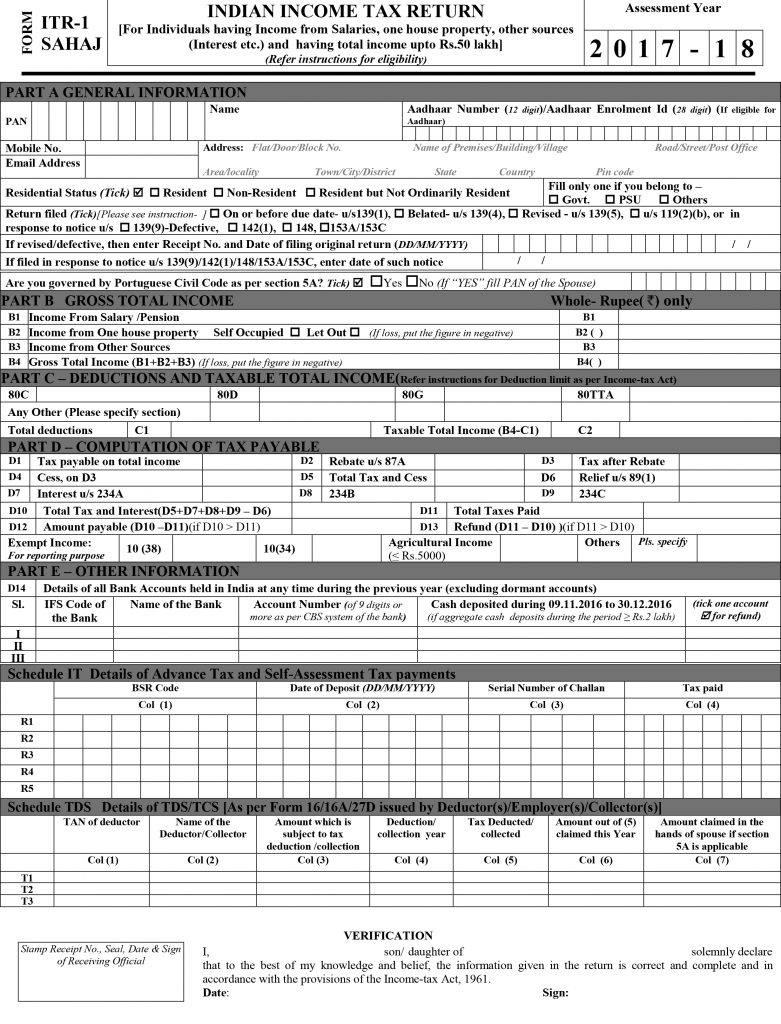

This form is also known as the Sahaj form. It is applicable for those earning less than 50 lakhs per annum from the following sources:

Starting from the FY 2017-18, the old ITR 2A, ITR 2 and ITR 3 were all merged to create the new ITR 2 form. This form is the one to fill up for individuals or a Hindu Undivided Family (HUF) deriving income from the following sources:

This form was formerly ITR 4 but has been renamed to ITR 3 for FY 2017-18. It is applicable to those who aren’t drawing a salary or pension as their principal means of livelihood. But these individuals are earning through their business or profession.

ITR form 3 is applicable to an individual or a Hindu Undivided Family. It can also include income from salary/pension, property, and other sources.

The former ITR 4S has been renamed to ITR 4 or ‘Sugam’. This form is applicable to those individuals or HUFs earning from business or profession who have chosen a presumptive income tax scheme as per Section 44AD, Section 44ADA, and Section 44AE of the Indian constitution.

However, they will have to opt for ITR 3 should the turnover of their business exceed Rs. 2 crores.

This form is applicable for the following organizations – firms, Limited Liability Partnerships (LLP), Association of Persons (AOP), and Body of Individuals (BOI).

This ITR should be filled by a representative of all companies barring those seeking exemption under section 11, i.e., exemption on property held for charitable or religious purposes.

This form is for companies filing returns under the following sections of the constitution:

That’s a wrap on the various types of ITR forms that one can file in India. The forms that individuals and Hindu Undivided Families need to look at are forms 1 to 4. On the other hand, forms 5 to 7 are applicable to business organizations, firms, and institutional bodies.

Knowing the right form to fill is the first step towards understanding how to file ITR, and this should give you more clarity on the various ITR forms applicable to an Indian citizen. You can find more information on filing income tax in India, here. Happy Tax Filing!